Last Updated on February 15, 2025

Opening a bank account in Bolivia as a foreigner is certainly achievable, but it’s not a straightforward process. Bank accounts in the country are only available to individuals who have at least “temporary resident” status, which allows them to obtain a foreigner’s ID card. This means that if you’re visiting as a tourist, with only a transitory residence status, you won’t be able to open a bank account here.

To open a bank account in Bolivia, you need at least temporary resident status (not just tourist status). You’ll also require your foreigner ID card, issued by the Bolivian government, and typically your passport, proof of income, a Bolivian address, and an initial deposit.

As Bolivian citizens and business experts, we’ll provide you with all the details, requirements, and steps for opening a bank account in Bolivia as a foreigner. We’ll also cover other services that Bolivian banks typically offer to expats and international clients.

Is it Possible to Open a Bank Account as a Foreigner in Bolivia?

According to Bolivian laws and regulations, you are permitted to open a bank account in Bolivia, but not as a tourist. You must be a temporary or permanent resident, or a diplomatic dependent.

To open an account in Bolivia, you need an Identification Document (this document is mandatory and cannot be bypassed). To obtain this document, you must be at least a temporary or permanent resident of Bolivia (not just a tourist), or be employed by a diplomatic institution such as an embassy or similar organization.

This Identification Document can be one of the following:

- A foreigner ID card (issued by the Bolivian government).

- A consular ID card, a diplomatic ID, or a credential card (all issued by the Bolivian Ministry of Foreign Affairs to embassy personnel, diplomats, and other similar dependents in the country).

As a tourist, you cannot open a bank account in Bolivia. You can only do so if you have “temporary resident” or “permanent resident” status in Bolivia (which, by the way, are prerequisites for obtaining a foreigner ID). Diplomatic employees can also easily open a bank account in our country.

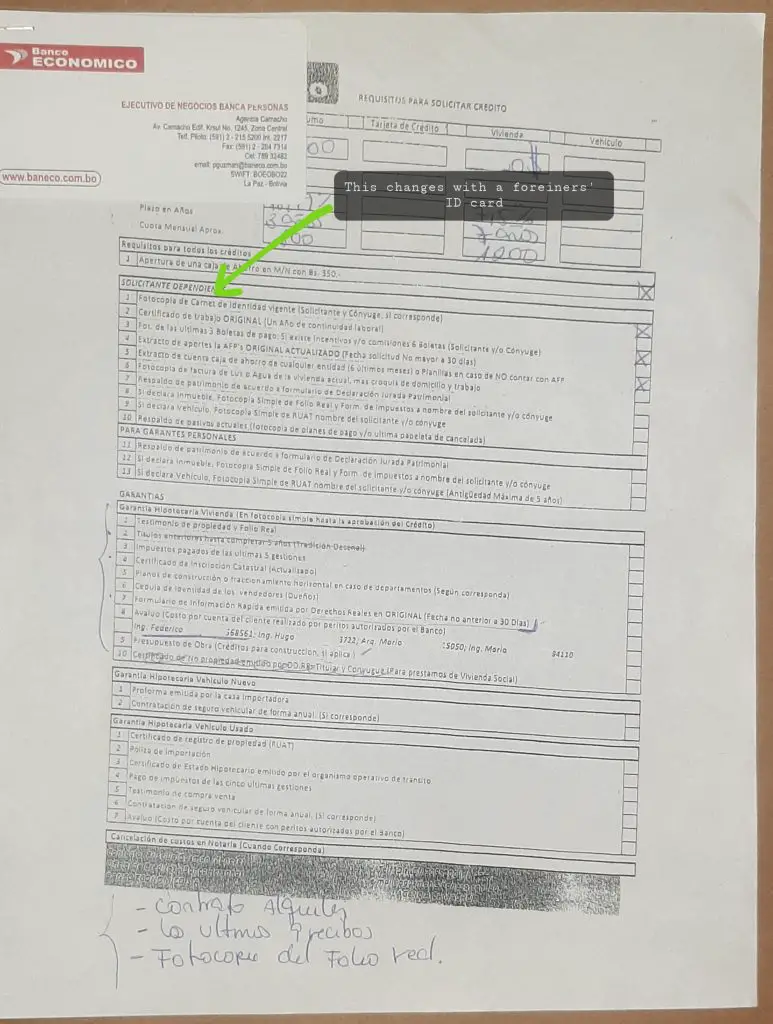

For example, here are the requirements that BCP Bank lists for foreigners to open a bank account in Bolivia:

- Requirements (translated).

If you have your Identification Document and meet the above conditions, you can open:

- A checking account

- A savings account

- A fixed-term deposit

In some cases, banks may also require you to meet other conditions, such as presenting your valid visa or passport, making an initial deposit, providing proof of your address, and/or *providing proof of your income in Bolivia*, among other things.

Once you have your Foreigner Identification Document, you’ll also need to choose a Bolivian bank to open this account. *Some banks are more willing and better equipped to serve international clients* (usually the largest ones), while others are less prepared or lack the necessary resources.

The Best Banks to Open an Account in Bolivia

We don’t have all the specifics about which bank is the absolute best for you, but we can assure you that most of the larger banks will be able to open an account for you without excessive additional requirements or delays.

We recommend the following banks:

- Mercantile Santa Cruz Bank

- BNB Bank

- Credit Bank

- Union Bank

- Bisa Bank

You can refer to our dedicated guide on the largest banks in Bolivia (which often also happen to be the best), providing detailed information and the services they offer: The largest banks of Bolivia: A complete overview.

Requirements to Open a Bank Account in Bolivia

Here, we’ll detail the requirements for opening a bank account in Bolivia as a foreigner. As you’ll see, the Identification Document is the most challenging requirement to fulfill; the others are relatively easy to meet.

The requirements and documents to open a bank account in Bolivia as a foreigner are:

- Your Identification Document (always):

- Your foreigner’s ID card, or

- Your diplomatic ID, or

- Your consular ID, or

- Another similar document.

- Your valid visa or passport (usually).

- Proof of address in Bolivia (usually).

- Proof of income in Bolivia (often).

- An initial deposit (often).

- Other specific documents (rarely).

Your Identification Document (Always Required)

By far, this is the most important and mandatory document you need to open a bank account in Bolivia.

Your Identification Document allows you to exercise all the rights that Bolivians typically have in the country. With this document, you can establish a company, obtain a driver’s license, *and also access the full range of Bolivian financial services*.

A valid Identification Document, such as a foreigner ID card, a diplomatic ID, a consular ID, or another similar document, provides you with a unique identity within the country.

From the perspective of Bolivian institutions and laws, with this “unique identity,” you can access the rights that both Bolivians and foreigners enjoy while living in the country. This is why it’s so crucial.

The Bolivian Constitution and laws state that:

- Any Bolivian citizen needs a standard ID card to exercise their legal rights and responsibilities.

- Any foreign citizen needs a foreigner ID card to exercise their legal rights and responsibilities.

However, this presents a challenge: as a tourist with a “transitory residence status,” you cannot obtain a foreigner ID card. Only by being a resident with at least “temporary residency status” can you obtain this foreigner ID card.

You can also obtain an alternative Identification Document if you are an employee of an embassy or similar diplomatic institution. This document could be a diplomatic ID, a Consular ID, a Credential, or a similar document.

Your Foreigner ID Card

To obtain this card, you need to apply for temporary residency status in Bolivia and have it approved. The paperwork for this process will cost around $200. *However, it’s not a simple process*. You’ll need to demonstrate that you intend to reside in Bolivia for reasons such as employment, health issues, studies, investments, owning a company, or similar justifications. *You cannot claim that you simply want residency for tourism purposes*.

Your Diplomatic ID, Consular ID, or Credential

If you work for an embassy or a diplomatic institution like the UN, the Inter-American Development Bank (IDB), a foreign non-profit organization, or similar, you can obtain either a diplomatic ID, a consular ID, or a credential. With these documents, you can also exercise all your rights in Bolivia, including opening a bank account.

We have a comprehensive guide on obtaining temporary residency status in Bolivia, as well as how to get a foreigner’s ID card, with all the necessary requirements and steps: Link.

Your Valid Visa or Passport (Usually)

Most of the time, banks will also require you to provide your valid passport, visa, or a similar document. These documents must be current (not expired) and valid for several months into the future.

It’s important not to confuse these documents with an Identification Document; they are distinct.

Proof of Address in Bolivia (Usually)

Often, you’ll also be asked to provide proof of your address or the place *where you reside in Bolivia*. This proof can typically be:

- A utility bill payment receipt.

- A document proving you are either the owner or tenant of the property.

- A rental invoice.

- A property tax payment receipt.

- Or similar documentation.

Proof of Income in Bolivia (Often)

Even though these types of accounts aren’t directly related to loans, you’ll often be asked to provide proof of your income in Bolivia (though *some banks may not require this*, and your foreign income might suffice). This is because banks in Bolivia tend to be more cautious with foreign clients.

This proof of income can be:

- A copy of your employment contract with your Bolivian employer.

- An extract of payments made by your Bolivian employer.

- A balance sheet and income statement of your business in Bolivia.

- Proof that you own your business in Bolivia or its assets.

- Proof of tax payments related to your business.

- Proof of rental income from your real estate property in Bolivia.

- Or similar documentation.

An Initial Deposit (Often)

Many banks will also require you to make an initial deposit to open your bank account. This initial deposit can range from $50 to $1,000, *but in most cases, it will be around $100*. Don’t worry; after your bank account is opened, you’ll be able to withdraw this initial deposit in full.

Other Specific Documents (Rarely)

In some banks, though it’s uncommon, you might also need to provide some of the following documents:

- Residence permit

- A personal reference

- Proof of ownership of a company in Bolivia

- Other very specific documents

A residence permit is the final document you receive upon approval of your temporary or permanent residency in Bolivia.

A personal reference might be requested to ensure you’re a trustworthy individual. If the bank encounters any issues with you as a client, they can contact this referenced person for assistance in resolving the matter.

If you’re opening a bank account through your business or company in Bolivia, proof of your ownership of the company, or your status as a representative, will always be required.

Steps to Open a Bank Account in Bolivia

- Choosing the most suitable bank for you.

- Visiting the bank you’ve chosen.

- Presenting all the required documents.

- Waiting for account approval.

- Receiving your account’s debit card and other materials.

1) Choosing the Best Bank for You

While almost all major banks in Bolivia should be able to assist you as a foreign client, you should also consider the following factors when selecting the best bank for opening an account:

Number of ATMs and Branches

The 12 major banks of Bolivia have varying numbers of ATMs across the country, ranging from around 100 to 500. However, *you can use any bank’s ATM, regardless of which bank you have an account with, by paying a small extra fee of around $0.20 per transaction*.

The banks with the highest number of ATMs available in the country are:

- Mercantile Santa Cruz Bank

- BNB Bank

- Union Bank

- Credit Bank

Minimum Initial Deposit

As mentioned earlier, some banks will require an initial deposit to open a bank account. This deposit can range from $50 to $1,000, *but it will most likely be around $100*.

You shouldn’t be concerned about this initial deposit, as you’ll be able to *fully withdraw it* once the bank account is created. In most cases, it’s simply a formality and a way to verify your commitment.

Monthly Fees

Bank account fees in Bolivia typically range from $0 to $5 per month, primarily *covering bank account maintenance and debit card insurance*. While you’re not obligated to purchase these account insurances, it’s generally advisable to do so. Some banks don’t charge any additional fees for having a bank account.

Regarding replacing a stolen or expired debit or credit card, you’ll typically be charged between $5 and $10 for a replacement. These fees are fairly consistent across different banks.

Furthermore, unused account fees are almost non-existent at Bolivian banks, so you won’t be charged extra for not using your account.

Interest Rates

In Bolivia, interest rates for various bank accounts *have remained relatively stable for the past decade*. You can expect the following:

- Interest rates for checking accounts are generally below 1% at almost all banks.

- Interest rates for savings accounts are around 2.5% at most Bolivian banks, but some offer 3.5% and, in some cases, even 4% per year.

- For fixed-term deposits, many banks offer around 5.5% per year, but some offer up to 6.5%.

Banks in our country generally fall within these ranges. It’s up to you to choose the bank that offers the best interest rates for your money.

Online Banking Services

In this area, Bolivian banks differ significantly. Some offer at least decent services, *but many have low-quality online services and platforms*.

We’ve also observed that the largest banks tend to have the best online experience. For the best services in 2022, we currently prefer the online experience offered by Mercantil Santa Cruz Bank.

In any case, we recommend the following three banks for online banking:

- Mercantil Santa Cruz Bank

- BNB Bank

- Credit Bank

Bank Account Insurance

All major banks in the country offer bank account insurance. It typically costs between $1 and $5 per month and will fully cover your bank account in the event of theft.

Additional Services for Foreigners

Once you have your foreigner ID card, you’ll be treated like a Bolivian by banks, *and you’ll enjoy the same services* that Bolivians typically receive.

However, to ensure the best experience, we recommend choosing the largest banks, such as Mercantile Santa Cruz Bank, BNB Bank, or Credit Bank.

Keep in mind that almost no bank in Bolivia will be able to assist you in your native language, whether by phone, social media, or in person. Unfortunately, banks here are not accustomed to serving clients from overseas who speak other languages.

2) Visiting the Bank You’ve Chosen

After selecting the right bank for you in Bolivia, you’ll need to visit it either in person or online to open your account.

We strongly recommend visiting in person, at least for the first time you open a bank account in our country. Even for us, we’ve found that opening a bank account online can be difficult, and it’s often not handled efficiently by the banks. Furthermore, the fact that you’re a foreigner complicates this option.

We have a dedicated guide to all the banks currently operating in Bolivia, including their contact information, locations, and other details about the quality of their services: Banks of Bolivia: List and a complete overview.

3) Presenting All Required Documents

Whether in person or online, you’ll be required to present all the necessary documents and proofs listed earlier in this article.

If you present them in person, the bank employee will ask you to provide the original documents along with photocopies.

If you submit them online, you’ll be asked for high-quality photos of both your Foreigner’s ID card and other documents.

4) Waiting for Account Approval

Once you’ve approached the bank and submitted all your required documents, your bank account will typically be opened within minutes, usually between 10 and 30 minutes. For online account opening, it will take a day or two after you submit the form.

5) Receiving Your Account’s Debit Card and Other Materials

After your bank account has been opened, the bank employee will provide you with all the opening documents, the contract, and a debit card linked to the account. You’ll also receive the credentials to access the online services for your account.

As you can see, the account opening process is very similar to what you’d experience in your own country. Banks in Bolivia are reputable institutions that generally adhere to industry best practices.

What we truly dislike about banks here is their lack of robust online services and platforms. These are often slow and unreliable. However, beyond this, Bolivian banks function very similarly to banks in other countries.

Opening a Bank Account for Your Bolivian Company

Remember that you can obtain a bank account in Bolivia through your Bolivian company, whether it’s a sole proprietorship (Unipersonal), a limited liability company (S.R.L.), or a corporation (S.A.).

To do this, you’ll need to provide a personal Identification Document, as well as proof of your ownership, partnership, investment, or representative status within the company.

When you have an S.R.L. or S.A. company in Bolivia, it’s considered a legal entity, *allowing it to have a bank account in its name* at any bank in the country. You can also open a bank account under your Unipersonal company in Bolivia, but it will be opened under your personal name.

To obtain this bank account, you’ll need to fulfill various personal and business document requirements. However, one of the following two *will always be required*:

- Your Identification Document, if your company is a Unipersonal.

- The Identification Document of your company’s representative (if they are a foreigner), or their Bolivian ID card (if the representative is Bolivian), for both S.R.L. and S.A. companies.

Other Services that Bolivian Banks Offer to Foreigners

Using ATMs and Credit/Debit Cards

Remember that you can use your foreign Visa or MasterCard credit or debit card at any ATM in Bolivia.

However, American Express is a different story, as this company is not widely supported by ATMs in Bolivia.

Additionally, if you obtain a debit card from a Bolivian bank, you’ll be able to use it for free at any ATM belonging to that bank and with very small fees at ATMs of any other Bolivian bank. Fees will generally be around $0.20 per transaction at other banks’ ATMs.

If you obtain a credit card in Bolivia (which *is possible if you have a stable income or job in the country* and, of course, your foreigner ID), it will also be supported by Visa or MasterCard, and you’ll be able to use it worldwide.

Money and Wire Transfers

With your Bolivian bank account, you’ll also be able to make internal bank transfers and international wire transfers. Bank transfers within the country will cost you $0, and for international wire transfers, the cost will be around 2% of the transfer amount.

Loan Approvals

It’s also possible for you as a foreigner to obtain a loan in Bolivia, whether it’s a home loan, business loan, or consumer loan. However, to qualify, you’ll need to:

- Hold at least temporary resident status in Bolivia.

- Have obtained your foreigner ID card.

- Demonstrate a stable and long-term source of income within the country, such as a formal job, or ownership of a company or investment.

- Frequently, the bank will require you to provide a collateral asset that you own as a guarantee. Since you are from another country, banks will be particularly cautious when extending loans, and in most cases, they will require collateral to secure the loan.

As you can see, obtaining a loan in Bolivia as a foreigner is certainly possible, but many banks will require proof of reliable income within Bolivia and asset guarantees to secure the loan.

Conclusions:

In this guide on obtaining a bank account in Bolivia as a foreigner, you’ve learned that it’s entirely possible, but you must first become at least a temporary resident of Bolivia and possess a valid foreigner ID card or similar document. These two requirements are unavoidable for opening a bank account in the country.

You’ve also reviewed all the requirements and steps necessary to open this bank account. You’ll need temporary residency status and a foreigner’s ID card in all cases. You’ll also typically need your valid visa or passport, proof of your address in Bolivia, and, less frequently, proof of Bolivian income and an initial deposit. In rare cases, you may be asked to provide other specific documents.

Finally, you now know that you can open this bank account primarily in person, but also online. The in-person process takes just a few minutes, while the online process can take one to two days. Additionally, you’ve seen that opening an account in Bolivia follows a similar process to that in other countries, as Bolivian banks are very similar institutions to banks worldwide.

We hope this information has been helpful. If you’d like to learn everything about the most important banks in Bolivia, including their details, contact information, and the quality of their services, please visit our dedicated guide here: Banks in Bolivia: A full list and all the details.

CasasenBolivia.com, information on living, working, investing, and traveling in Bolivia.